Pledge Form

Your support helps TCT cover the world!

“Give, and it will be given to you. Good measure, pressed down, shaken together, running over, will be put into your lap. For with the measure you use it will be measured back to you.” (Luke 6:38)

We believe every Word of the Bible is true, and we want to help you grow in it! If you are in need of prayer we have a prayer line available 24/7 with someone waiting on the other end of the line to lift up your request before the Lord. There is no need too great or too small for God. Call 1-800-232-9855 or click here to send in a request.

If you would partner with us to spread the Gospel, any donation large or small lays down a brick in the road being paved for the Kingdom.

Thank you for your generosity!

TCT can be live streamed from our web site 24 hours a day. Many of our programs are also available for viewing on demand. Along with the traditional access in many areas through over the air, satellite, and cable companies, TCT is also available on iOS, Android, Roku, Amazon Fire, Apple TV, Android TV, Tizen, and Xbox One. We continue to strive to make our programming accessible anytime and anywhere around the world!

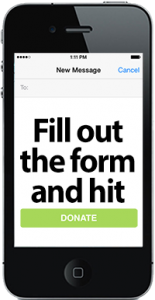

To donate by Credit Card or “Easy Pledge” today, go to our online donation page.